House price growth expected to be greater in affordable rural areas and slower in city centres, says leading economist at Office for Budget Responsibility.

-

Remote working has permanently changed the housing market as it enables people to leave cities and live in the countryside

-

This has lead to greater price growth in rural areas, but slower growth in cities, creating a more level prices for home buyers

-

The Office for Budgetary Responsibility predicts house prices will fall from their peak in the fourth quarter of 2022, before rebounding in the second quarter of 2024

The trend to work from home is expected to keep house prices more affordable for first-time buyers in the next few years.

The Office for Budgetary Responsibility predicts house prices will fall from their peak in the fourth quarter of 2022, before rebounding in the second quarter of 2024.

By the end of 2025 they are forecast to rise by 2.8% year-on-year, with uplifts of 3.6% in 2026 and another 3.6% in 2027.

Remote working, triggered by the pandemic, will permanently change the housing market, as it enables people to leave cities and live in the countryside.

Leading economist at the Office for Budget Responsibility, David Miles, says the situation will push up property values in rural areas, but lead to slower house price growth in city centres and London.

Why is this happening?

The Covid-19 pandemic has led to permanent changes to people’s working patterns, with many people now allowed to work remotely all or some of the time.

In the past, cities typically saw higher price rises than rural areas due to a mismatch between supply and demand, driven by employees wanting to live within easy commuting distance of their place of work.

But the ability to work from home has eased that imbalance, and instead led to greater demand for homes in the countryside, which by extension will lead to higher house price growth in these areas.

Who does it affect?

The trend is good news for first-time buyers. Earnings growth has failed to keep pace with house price rises for much of the past decade, making property increasingly unaffordable for those trying to get on to the housing ladder.

Slower house price growth not only gives earnings a chance to catch up, but it also means first-time buyers will not face the race to put together a deposit before they get priced out of the market.

The situation is also positive for those living outside of city centres, as it suggests house price growth will be more evenly spread going forward.

This should make it easier for people to relocate from the countryside to towns and cities if they choose to, as well as move between different regions.

What’s the background?

House price growth has already slowed down compared with previous years due to the impact of higher mortgage rates and the rising cost-of-living on affordability.

Buyer demand is currently below average in the Midlands, South East, South West and East of England, areas that have seen the highest house price rises in the past three years, which has impacted affordability.

Across the UK as a whole, house prices have edged down by 1.3% during the past six months, and are expected to remain broadly unchanged for the rest of the year.

After a strong recovery of the market at the start of 2023, recent mortgage rate rises are hitting buying power again and more sellers are now offering discounts

-

We expect to see modest price falls of up to 5% for the remainder of 2023, higher mortgage rates are affecting buying power up to 20%

-

Sellers accepting discounts of more than 5% has spiked to 42%, similar to reductions made in 2018

-

Serious sellers in 2023 needs to be realistic on pricing to achieve a sale

Mortgage rates reach 5% and above

After a better-than-expected start to 2023, recent inflation figures and the subsequent Bank Rate rise have triggered an increase in mortgage rates, up from 4.5% to 5%-6%.

5% and above mortgage rates begin to represent a shift in the market.

Once rates go higher than this, buying power is affected and we can expect to see annual house price falls and fewer homes selling.

Falling mortgage rates can boost sales and lead to firmer prices.

This is set to reverse as higher mortgage rates hit buying power at a time when sellers are having to accept larger discounts to asking prices.

Sales momentum recovers in the first half of 2023

Despite rising mortgage rates, the housing market is still busier than it was before the pandemic.

The total number of sales agreed in the first 5 months of the year recovered to within 2% of the 5-year average.

In the last 4 weeks, the number of sales agreed rose to 8% above the 5-year average, as people looked to move before mortgage rates increased further.

A strong employment market, with rising earnings and falling energy prices, had boosted UK consumer confidence, alongside mortgage rates falling towards 4%.

As sales volumes increased, so too did house price growth, sparking a reversal of the house price falls at the end of 2022 and the beginning of 2023.

There are now early signs of a seasonal decline in demand, which is likely to expand over the summer.

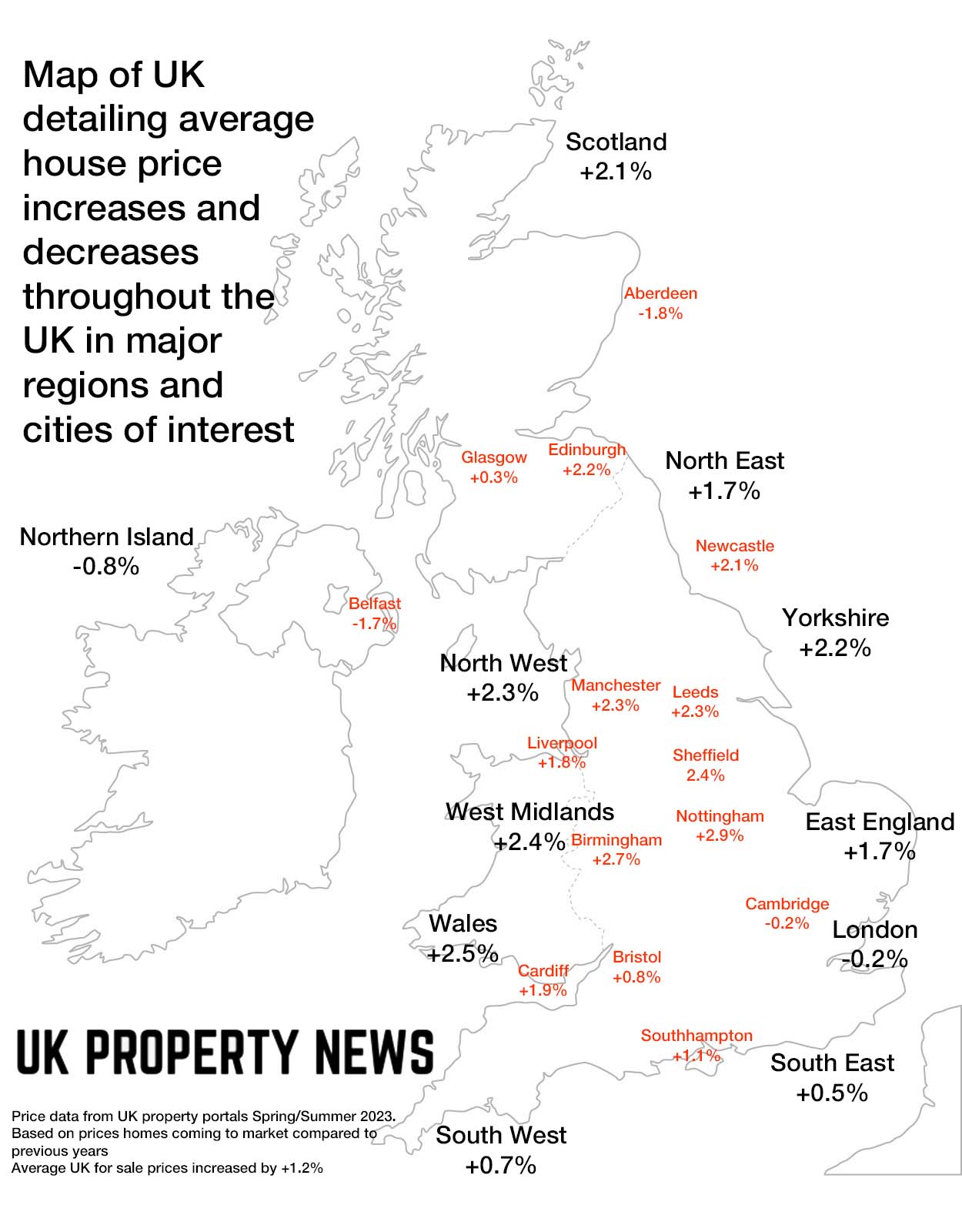

What’s happening to house prices where you live?

While quarterly price falls have slowed, the annual rate of UK price growth has shown a rapid loss of momentum over the last year, slowing to +1.2%.

All areas of the UK are still experiencing positive house price growth, except for Northern Ireland (-0.8%), London (-0.2%), Cambridge (-0.2%), Belfast (-1.7%) and Aberdeen (-1.8%).

In Wales, house price growth is comfortably up at +2.5%.

In Scotland and the North-East, where housing is more affordable, and the capital, where price rises have under-performed, the number of new sales being agreed continues to run above the national average.

However, in the East of England, South-West, East Midlands and South-East, sales volumes remain at or below average.

These regions registered some of the greatest gains over the pandemic years. But they are now the places where house prices will need to adjust the most, as homes here become less affordable while higher mortgage rates are impacting buying power.

In the last 4 weeks, we’ve seen a 14% drop in buyer numbers compared to the 5-year average.

For the rest of 2023, we expect sales momentum to slow as higher mortgage rates hit buyers and squeeze more out of the market, bringing a return to modest quarterly price falls.

UK house prices remain on track to fall by up to 5% over 2023.

30% of sellers discount their asking price by 5% or more

Buyers are driving a harder bargain on agreed pricing to combat the increased interest rates.

Sellers are having to accept lower offers that are 3.8% (on average) below the original asking price.

We have also seen a jump in the proportion of sellers accepting bigger discounts.

42% of sellers are accepting offers of more than 5% below the asking price; the highest level since 2018, when annual UK house price growth was just 1%.

And over 1 in 6 sellers are accepting discounts of more than 10% below the asking price, a level that remains more stable.

Surge in supply could drive larger price falls

A surge in the supply of homes for sale also increases the risk of house prices falling.

There are some signs that supply is starting to grow at an above average rate, with 18% more homes listed for sale in the last 4 weeks compared to the 5-year average.

The number of homes for sale is now back to pre-pandemic levels.

If this increases further, either through voluntary or forced sales, the boost in supply would give buyers further room to negotiate on prices.

Sellers must be realistic on pricing if they want to move

The desire to move home isn’t all about aspiration for a bigger or better property.

The rising living and housing costs will continue to keep owners reviewing their housing needs, with moving becoming the best option for some out of choice or necessity.

Whatever the motivations, the key message for anyone serious about moving in 2023 is the need to be very realistic on price, seeking the views and expertise of local agents as they plan their move.

Overview of the market

The resilience of the housing market and homebuyers is set to be tested once again as mortgage rates increase over 5%.

Firmer pricing this spring shows 4-5% mortgage rates are manageable, but the longer rates stay over 5% and closer to 6%, the more the increased hit to buying power will result in lower prices and sales volumes.

There is a large equity buffer to absorb house price falls, making the risk of negative equity much smaller than in previous downturns.

The bigger challenge for housing activity is the affordability of monthly payments for buyers and those remortgaging, set against the wider increase in other costs of living.

Household budgets are being squeezed and we look set for a prolonged period of very low nominal house price growth, which will see steady re-alignment of house prices and household incomes over the next 3-5 years.