Over 60% of landlords are being hit by higher mortgage rates, risking a further squeeze on the number of rental homes available.

-

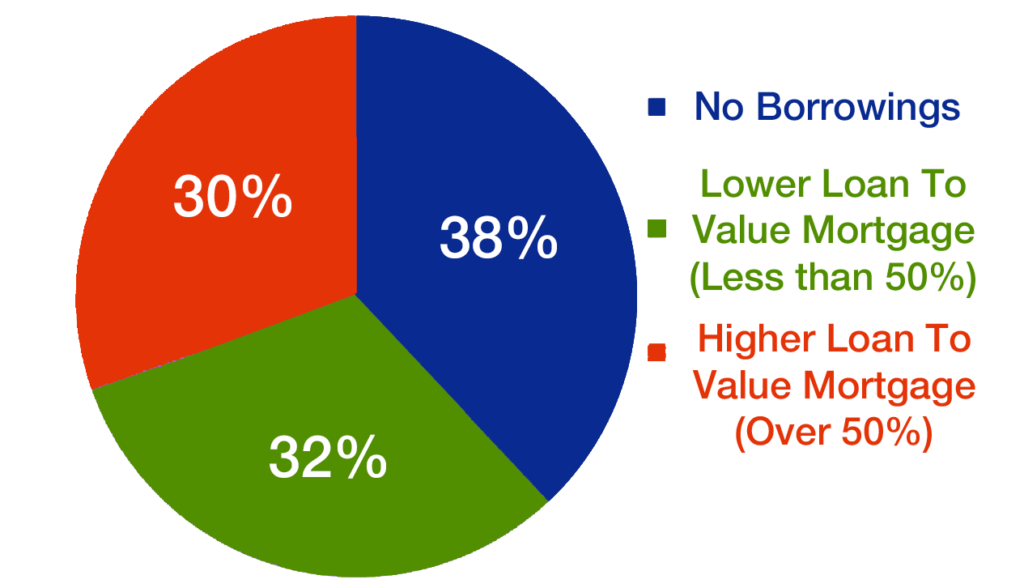

Higher mortgage rates are hitting landlords who have loan to value mortgages of 50-75% hard. And that accounts for 20-30% of landlords

-

51% of all landlord sales are taking place in London and the South East, the two most expensive property regions in the UK

-

While some landlords are selling, the likelyhood of all landlords exiting the private rental sector is unlikely

More than a third of landlords own their properties outright, while another third have loan to value mortgages of less than 50%.

But for the remaining 20-30% of landlords, whose mortgages have a loan to value of 50-75%, higher mortgage rates are more significant.

As mortgage rates creep up, landlords are forced to use more of their rental income paying back lenders, which in turn reduces their own income and creates a squeeze on cashflow.

The net result is the increased likelihood of a sale as landlords approach refinancing.

Higher mortgage rates are unwelcome but more manageable for landlords at lower loan to value mortgages as there is greater free rental cashflow to absorb higher mortgage rates.

In London and the South East, the two most expensive property regions in the UK, so many landlords are selling that these two regions account for 51% of all landlord sales.

Because homes in these areas are expensive to buy and therefore offer low rental yields, or return in investment once the monthly mortgage is paid, the economics of being a landlord here are tougher than other areas.

Rising mortgage rates are hitting profitability hardest in these regions, especially for higher rate taxpayers.

How to keep a buy-to-let property in the face of rising mortgage rates?

The main option for landlords facing a big increase in mortgage interest payments is to inject equity at refinancing.

However, this will be an unattractive option for many with concerns over low yields and the risk of further price falls.

Increasing the rent by up to 10% each year, can also assist, however this isn’t always possible dependant on the terms if the tenancy.

Will all landlords be exiting the private rented sector?

While some landlords are selling up, talk of an exodus is unlikely.

Sales data continues to show a steady, constant flow of private landlords selling, but this has been the case since 2018. The level of landlords’ sales isn’t accelerating.

Corporate and institutional landlords are continuing to invest in homes and for this reason the number of private rented homes available has remained at the same level since 2016.

We don’t expect to see a worsening of supply. However, the market does need significant investment from more private and corporate landlords to help with the demand for rental homes.

Right now, there are 33% less homes available to rent than the five year average, yet demand is currently running at 50-85% above average.

1 in 10 homes for sale were formerly rented out

Over 1 in 10 homes for sale on the UKs portals are former lettings.

However, this percentage has been broadly consistent for the last 3 years as a proportion of private landlords rationalise their portfolios or exit the market in the face of tax changes and higher borrowing costs.

Before the pandemic, data shows that half the number of ex-rental homes put up for sale either went unsold, so continued to be rental properties, or they were bought by another investor.

This helped to limit the loss of rented homes from the private rented sector.

However, more recently, the proportion returning has dropped to 30%. And that means more homes are now being lost from the rental market than can be replaced by the flow of new investment.

With increased mortgage rates; rental increases outpace earnings for 21 months in a row

The average UK rent has hit £1,126 a month, rents in London averging £2,000 a month. Where are rising rising the fastest in the UK?

-

The average UK rent reached £1,126 in April, £110 higher than a year ago

-

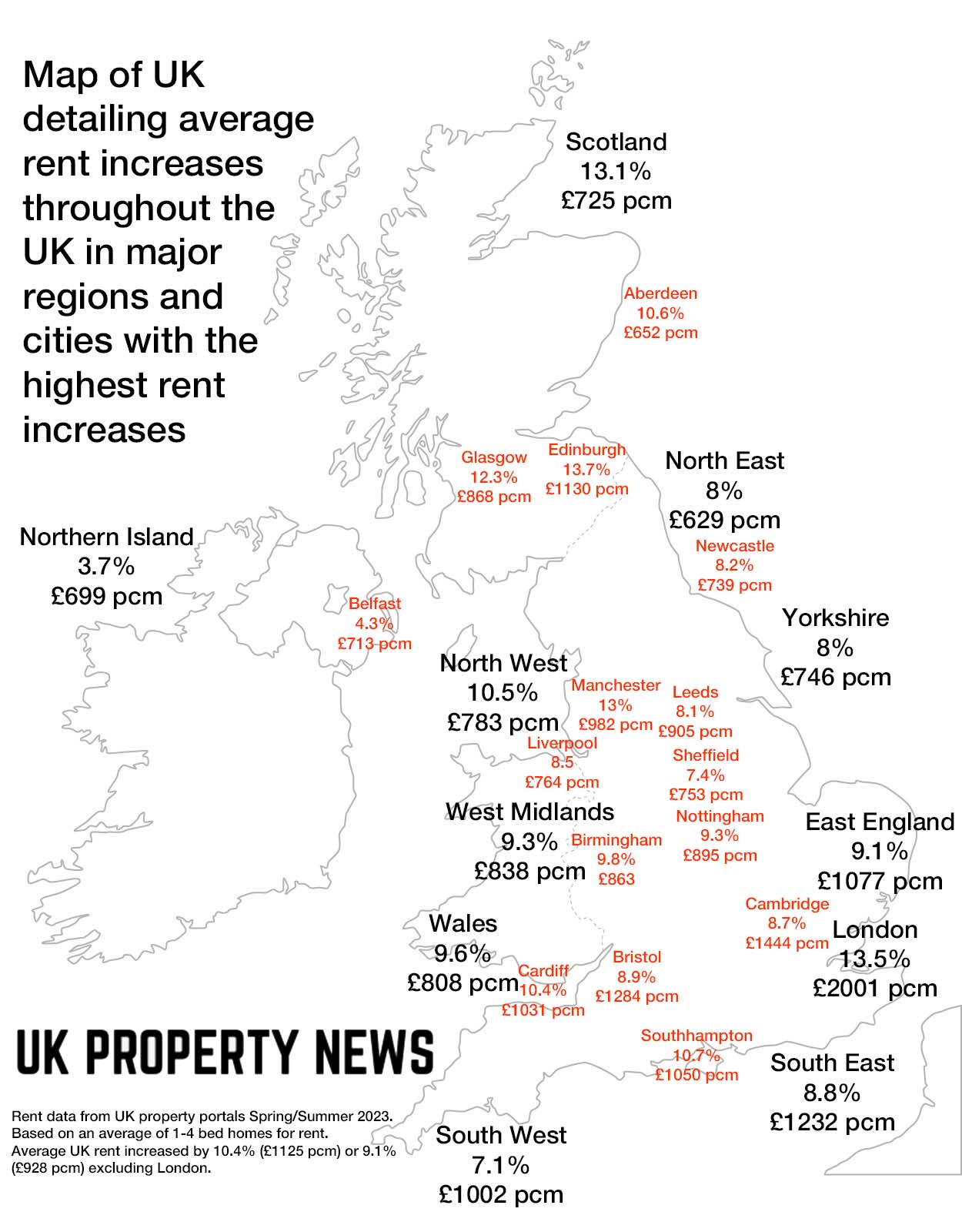

London remains the region with the fastest growing rents; up 13.5%, while rental inflation in Northern Ireland slows to 3.7%

-

The average rent in London reaches £2,000 per month, but rental growth slows in inner London over last 3 months

-

Outside the capital, rents are increasing the most in Dundee, Edinburgh and Luton

Rents increase by more than 10% for 15th month in a row

In April 2023, the average cost of a new let rose to £1,126 per month, following 21 consecutive months in which rental rises outstripped wage rises.

The average UK rent has now increased by £110-a-month – or 10.4% – since April 2022, marking the 15th consecutive month that we’ve seen double digit growth in rental inflation.

This level of rental inflation is high by historical standards and ahead of average earnings growth, which is currently at 6.5%.

The gap between these measures highlights the impact on rental affordability, which is now at a record high in seven out of 12 UK regions.

The good news is that rents for new lets have been starting to slow reflecting seasonal trends. In the last 3 months, the average rent increased by 0.6% – that’s the smallest amount since May 2021.

Rental inflation lowest in Northern Ireland

London and Scotland, two of the largest rental markets, have seen the highest level of rental inflation at +13% since April 2022. This is well ahead of the typical annual growth of 4.5% to 5% we’ve seen in these regions over the previous 5 years.

Northern Ireland remains the region with the lowest rental inflation – 3.7% or an increase of £30 per calendar month since April 2022.

Average rent in London reaches £2,000 per month

Over the last 2 years and since the economy reopened after Covid lockdowns, the average London rent has increased by £490 a month. This brings the average rent in the capital to £2,001.

At present, the largest annual increases are recorded in the eastern boroughs of Newham (+18.1%), Greenwich (+18.0%) and Tower Hamlets (16.5%).

Those living in the suburbs and western edges of central London are seeing a smaller level of rental growth. The annual rental inflation is weakest in Kensington and Chelsea (10.2%), Havering (11.3%) and Richmond (11.4%).

Prices of new lets in inner London start to slow down

The good news for many renters is that the rate of rental inflation is slowing down in inner London. The monthly rent for a new let in inner London is only £26 higher today than it was in January 2023.

This is an indication of prices hitting their ceiling in this area, as renters struggle to afford higher rents. We are yet to see if this trend will continue with the high-demand summer season ahead of us.

Prices of new lets are growing at a much faster rate in suburban boroughs. Over the last quarter, rental prices in outer London increased by 3% (£47) per month. These more affordable areas are now attracting more demand from renters looking for cheaper alternatives to inner London.

Varying rental growth in UK cities

Fast-growing rental inflation is not only a London problem.

Our rental index identifies three urban areas where rents are increasing faster than in London: Dundee (+14.5%), Luton (14.0%) and Edinburgh (13.7%).

Renters looking for new lets in these locations will find the average monthly rent has increased by up to £140 over last year.

We also record above-average rental inflation in Manchester, where the average monthly rent has increased by £110 over the last year.

The cities where rents are also increasing faster than average include Glasgow (12.3%), Southampton (10.7%) and Cardiff (+10.4%).

The average rent in these cities is now £100 higher than a year ago.

The lowest rental growth is currently happening in the city of Doncaster and the towns of Grimsby and Blackpool.

The typical monthly rent in these areas has increased by less than £30 per month (4.3%) since April 2022.