Property values rise at their fastest rate since 2007, as house price growth hits a 15-year high.

The average UK property has risen by £29,000 in value since March 2020, according to our latest House Price Index.

The effects of the pandemic continue to drive one of the busiest housing markets since 2007, as buyers make a once-in-a-lifetime reassessment of their housing needs.

Find out how much your home is worth

What’s happening to house prices?

House prices have risen by 8.3% during the past year, taking the cost of the average home to £249,700.

Discover what £250,000 buys you across the UK

The growth in property values seen during the three months to the end of March is the highest in 15 years.

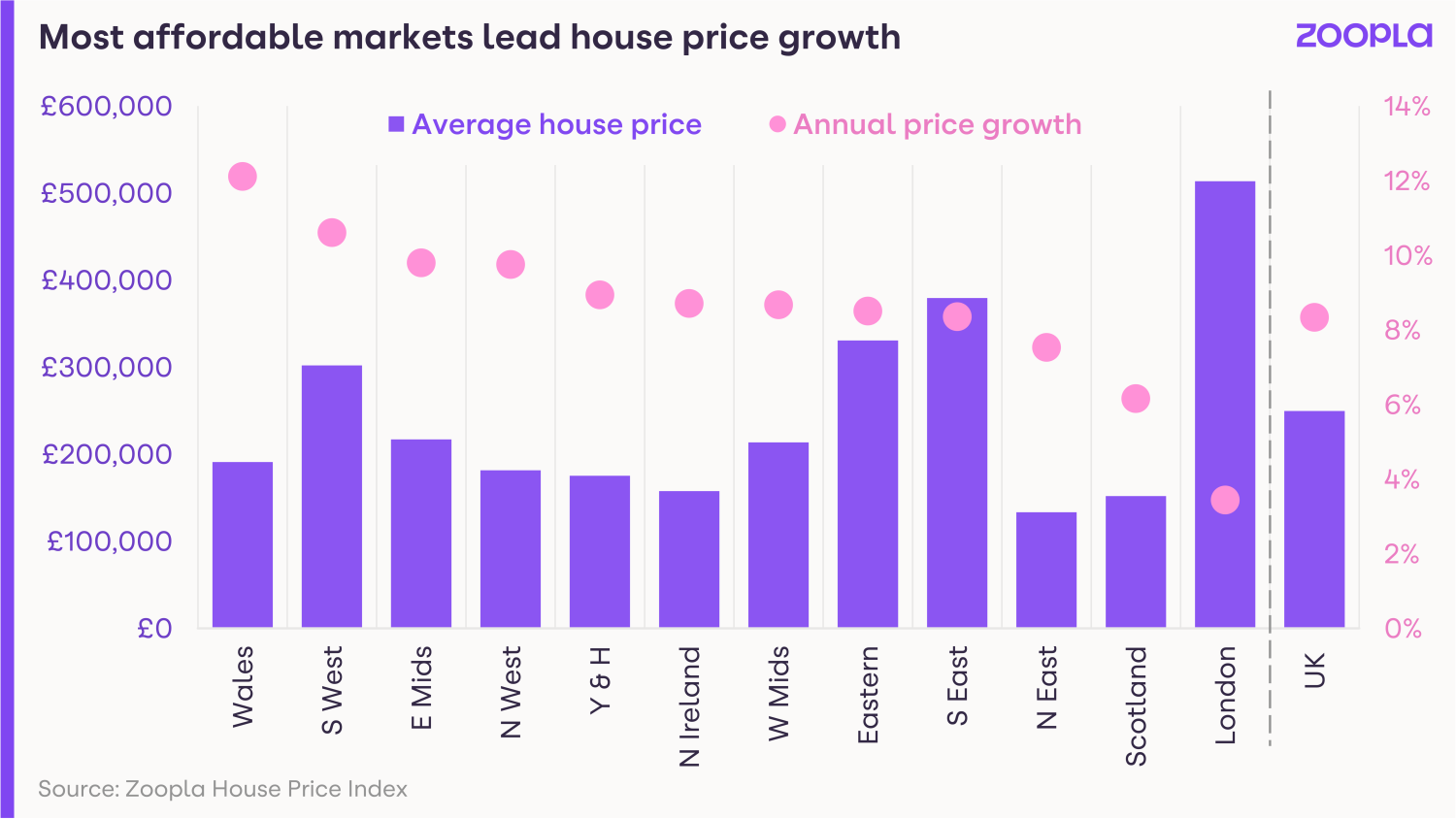

Wales has continued to see the greatest house price increases at 12.1%, followed by the South West at 10.6%, as buyers looked for homes in rural and coastal areas.

Northern cities, where property remains more affordable, also continued to outpace their southern counterparts, with Liverpool recording growth of 10.1%, followed by Nottingham at 9.8% and Manchester at 9.5%.

At the other end of the scale, gains were lowest in London at 3.4%, with property values just 2% higher than at the start of the pandemic.

How busy is the market?

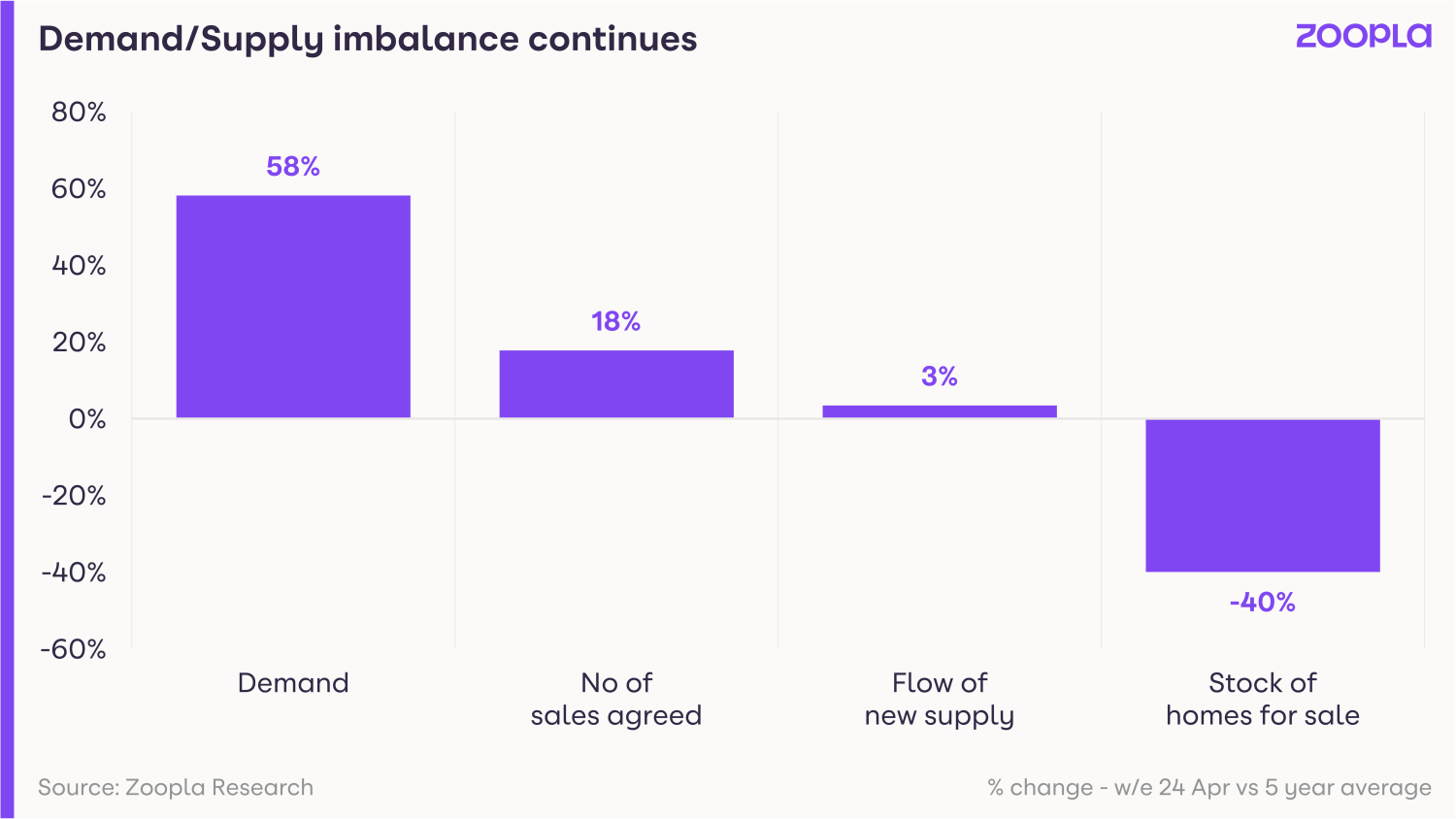

The number of potential buyers in the market remains elevated, with demand 58% above the five-year average, in part driven by ongoing pandemic-related factors, such as hybrid working.

That said, city centres are continuing to experience a rebound in demand as workers return to the office.

The emergence of property hotspots

Meanwhile, the supply of homes is also starting to increase, with the number of properties being put up for sale in March 3% higher than the five-year average.

Although demand continues to significantly outstrip supply, and the number of homes for sale is still 40% below the five-year average, supply hotspots are starting to emerge.

Kensington and Chelsea in London has seen the biggest increase in listings at 53%, followed by Erewash in the East Midlands at 45%.

The number of homes for sale in Pendle in the North West is up 38%, while Elmbridge in the South East has seen a 38% rise.

Overall, sales agreed in the run up to Easter were 27% higher than their pre-pandemic level.

How rising values are affecting stamp duty payments

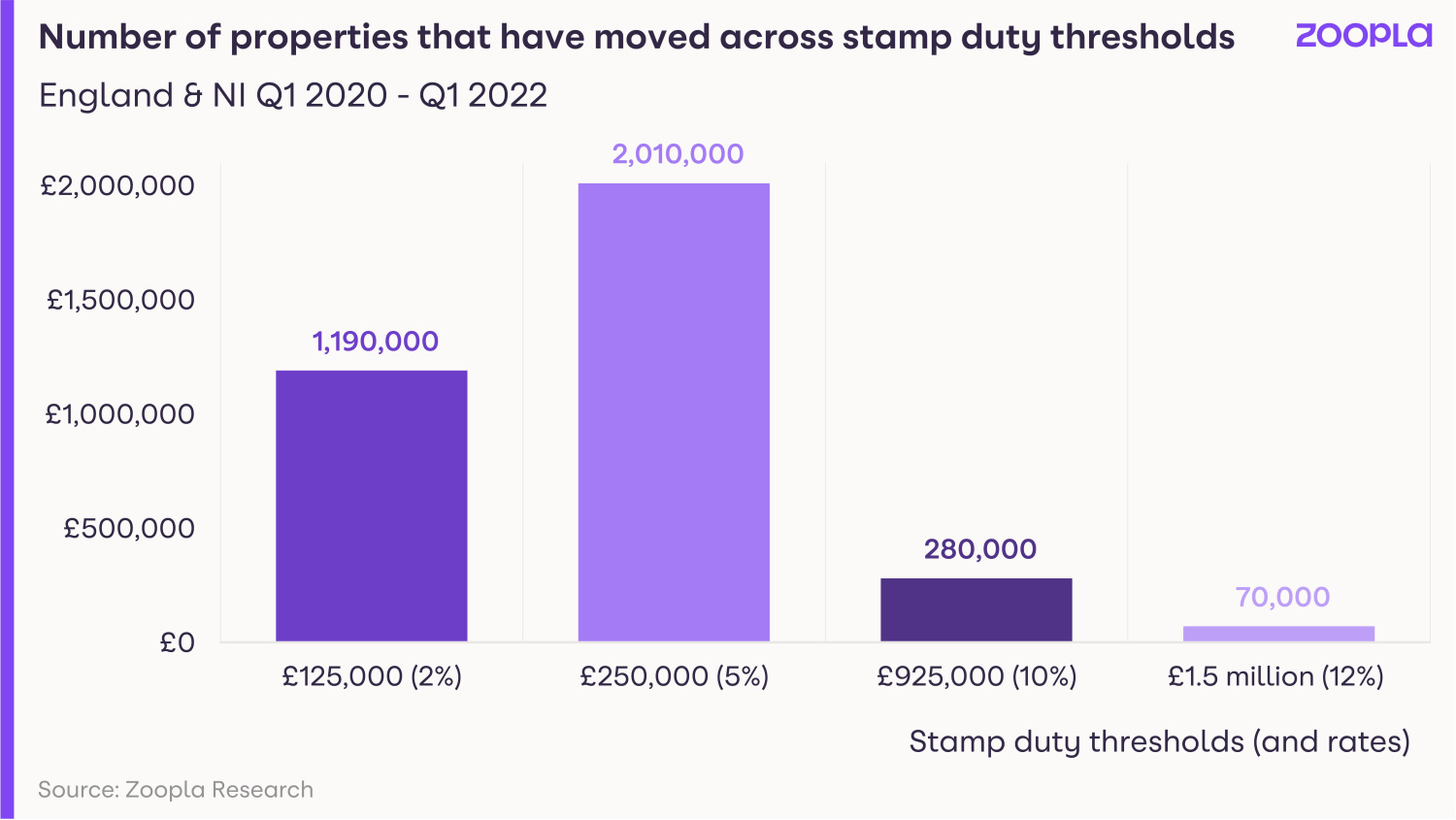

The increase in property values has led to 1.2 million properties in England and Northern Ireland moving above the £125,000 threshold at which stamp duty kicks in.

In Wales and Scotland, 360,000 homes are now worth more than the threshold at which the tax starts.

As a result, stamp duty will now be payable on an additional 1.5 million homes when they change hands, compared with at the start of the pandemic.

The situation means buyers face a higher tax bill when they purchase a new home, at a time when they are already grappling with increases to the cost of living.

First-time buyers will also be hit, with an additional 1.9 million properties valued at more than the £300,000 threshold at which stamp duty kicks in for those purchasing their first home.

What could this mean for you?

First-time buyers

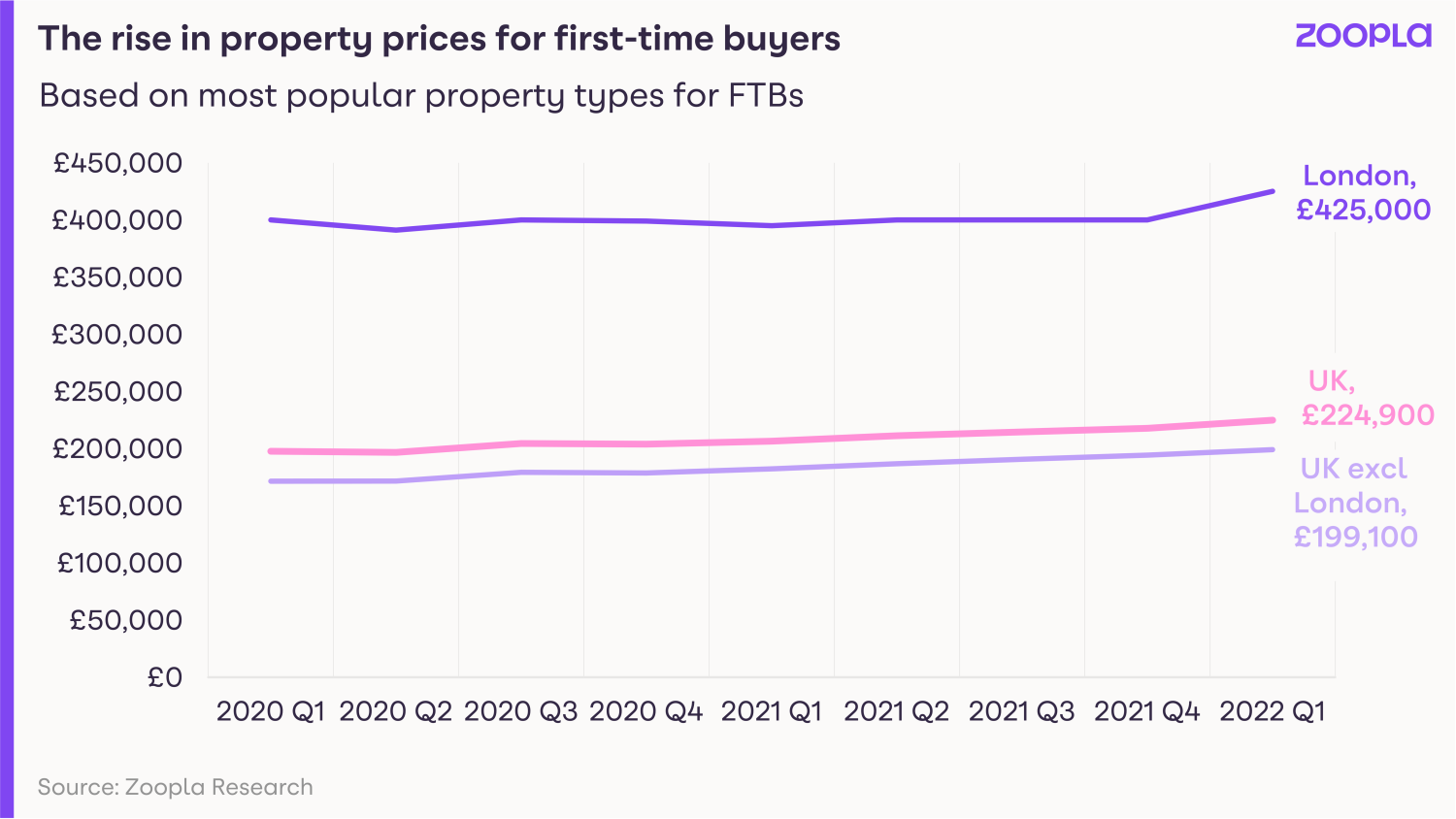

The strong house price growth seen during the past two years is bad news for first-time buyers.

The typical person taking their first step on the property ladder now spends £225,000 – £27,000 more than two years ago.

As a result, first-time buyers need an additional £4,000 for a deposit, while they will need to earn £5,000 more each year in order to secure a mortgage, based on someone putting down a 15% deposit and borrowing 4.5 times their income.

Unfortunately, earnings growth has not kept pace with house price increases, with average annual salaries rising by only £2,704 during the past two years.

But there is some good news, as price increases have been less pronounced in some markets than others, with the price of two-bedroom flats in London broadly unchanged since the start of the pandemic.

Home-movers

The increase in the number of homes coming on to the market is good news for home-movers, as it not only means they will have more choice for their next purchase, but competition among potential buyers should also be less intense.

Existing homeowners will also have benefited from the strong house price increases seen during the past two years.

That said, those trading up the property ladder are still likely to need to borrow more than they would have done two years ago to secure their next property.

With the market expected to cool during the second half of the year, those with a property to sell should think about listing it as soon as possible to take advantage of the current buoyant market conditions and lock in the gains they have made.

What’s the outlook?

The housing market looks set to slow down during the second half of the year, as economic headwinds, such as the rising cost of living and higher mortgage rates, put pressure on house price growth.

Meanwhile, the pandemic-induced sales boom, triggered by people looking to move to homes with more space, will also begin to normalise.

But while the number of homes coming on to the market has started to increase, the ongoing shortage of supply will prevent house price falls.

Gráinne Gilmore, head of research at Zoopla, said: “We forecast last year that strong demand would continue through the start of the this year, but that the market would return to more ‘normal’ pre-pandemic conditions from the summer.

“All in all, this will result in a slowing in price growth in 2022, although it will remain in positive territory. We have forecast 3% growth in December, but the move from 8.3% to 3% may not be a linear progression, and it may take until early 2023 before price growth hits this level.”