Rents dip as inflation picks up

The average tenant would have saved £1,611 annually had rents tracked CPI since 2015.

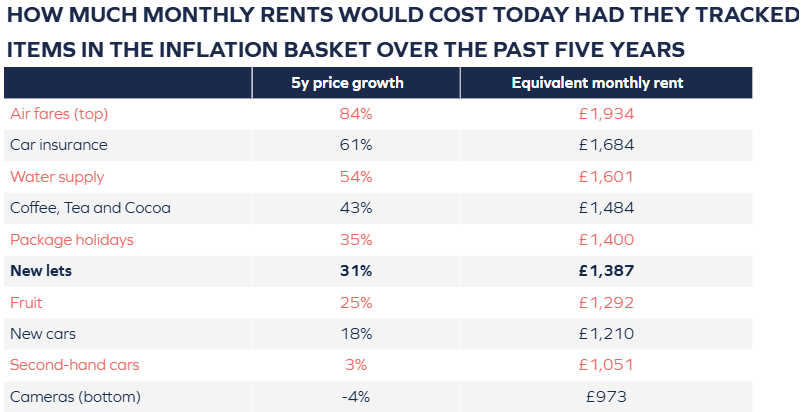

Rents across the UK fell by 0.4% year-on-year in August 2025, bringing the average monthly rent down to £1,387. While the decline is modest, it marks the joint second-largest annual fall in rents since the index began in 2011, and the largest since the post-Covid dip in 2020.

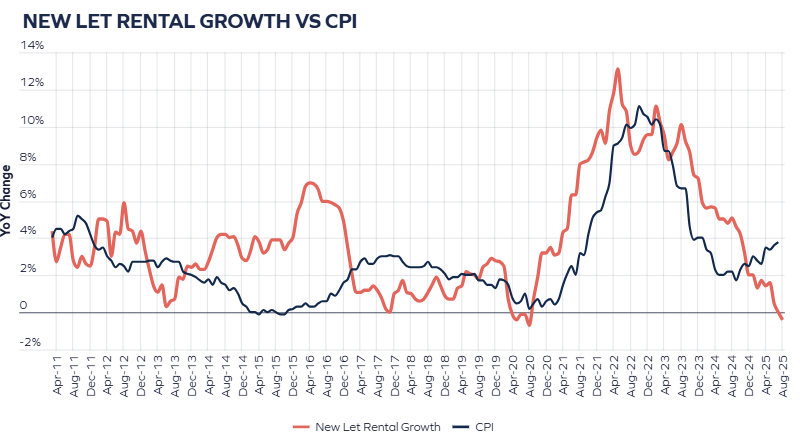

This drop also represents the ninth consecutive month where rental growth has lagged behind inflation. With the Consumer Price Index rising by 3.8% in July, tenants are finally seeing a rare moment of respite. For much of the last five years, rapidly rising rents had been a key contributor to the UK’s inflation story.

-

Rents Dip in August 2025:

-

UK rents fell by 0.4% year-on-year, bringing the average monthly rent to £1,387.

-

This is the second-largest annual drop in rents since 2011, following a post-Covid dip in 2020.

-

Rents have lagged behind inflation for 9 consecutive months.

-

-

Impact of Inflation:

-

CPI inflation rose by 3.8% in July 2025, while rents increased by only 0.4%.

-

For the past five years, rapidly rising rents contributed significantly to UK inflation.

-

-

Market Shift:

-

Tenant demand softening and affordability pressures mounting are forcing landlords to adjust expectations.

-

Unlet homes increased by 8% compared to last year, and the number of renters starting their search dropped by 4%.

-

The rental market may be shifting towards favoring tenants.

-

-

Rents vs Inflation:

-

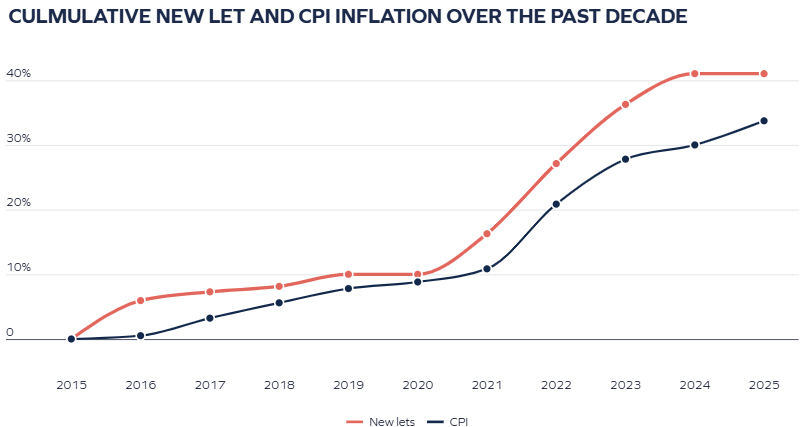

Over the past 5 years, rents rose by 31%, outpacing CPI inflation (24.9%).

-

Over the past 10 years, rents grew by 41%, compared to CPI’s 34%.

-

If rents had tracked inflation, tenants could have saved £952 annually over 5 years, and £1,611 annually over 10 years.

-

-

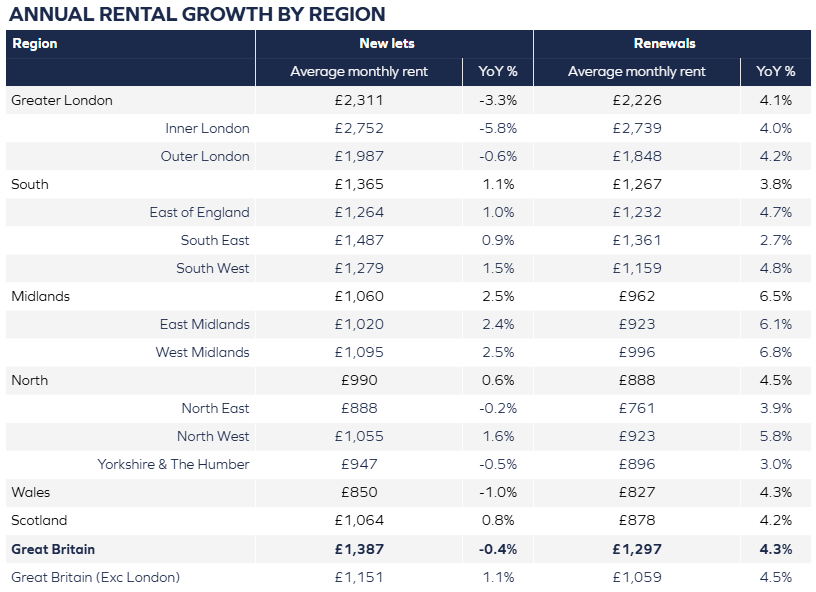

Regional Variations:

-

Rents fell in four regions, with London seeing the largest drop (Greater London -3.3%, Inner London -5.8%).

-

This marks the 8th consecutive month of rental declines in London.

-

North East and Yorkshire & Humber also saw slight declines (0.2% and 0.5%).

-

The Midlands, South West, and Scotland saw rental growth, especially in the West Midlands (2.5% for new lets, 6.8% for renewals).

-

-

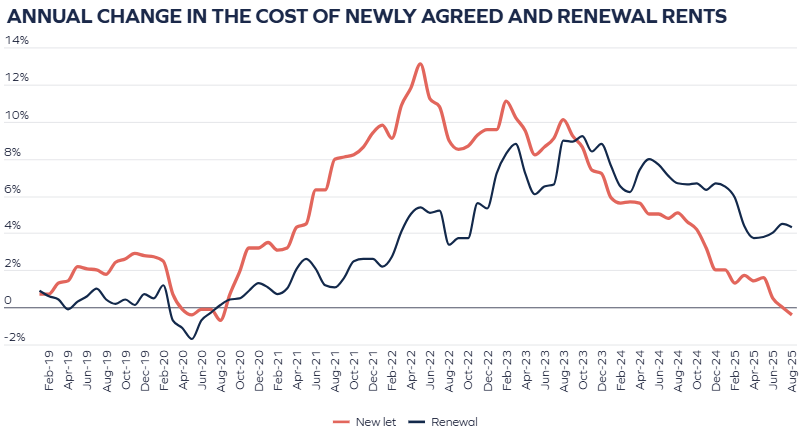

New Lets vs Renewals:

-

Renewing a tenancy was 4.3% more expensive, while new lets saw a small fall.

-

Renewals are now £90/month cheaper than new lets, though the gap is smaller than the £170 difference in October 2023.

-

The cost of renewing a tenancy may continue to rise, but growth is expected to slow as affordability pressures build.

-

-

General Trends:

-

Real-term rent declines are occurring (when inflation and wages outpace rental growth).

-

This is a rare occurrence, providing tenants with some financial relief.

-

The rental market is adjusting to wider economic pressures, which could alleviate inflation concerns for policymakers.

-

The slowdown in rental growth is not just a blip—it’s part of a broader recalibration. As affordability pressures mount and tenant demand softens, landlords are increasingly having to adjust their expectations. The number of unlet homes on the market was 8% higher in August than the same time last year, while the number of renters beginning their search fell by 4%. These shifts suggest that the balance of power in the rental market may be starting to tilt back toward tenants.

Rents vs the Inflation Basket – What Could Have Been

While the recent dip in rents is notable, it comes after a prolonged period of rapid growth. Over the past five years, rents have risen by 31%, outpacing CPI inflation, which grew by 24.9% over the same period. Stretch that comparison to a decade, and the gap widens even further – rents are up 41%, while CPI has increased by 34%.

This disparity has real financial consequences. Had rents simply tracked inflation over the last five years, the average tenant would now be paying £1,308 per month—saving £952 annually. Over a ten-year horizon, the savings would be even greater, with tenants paying £1,611 less each year than they currently do.

To put this in perspective if rents had followed the same trajectory as air fares, tenants would now be paying £1,934 per month. That’s nearly £550 pcm more than today’s average. On the other hand, if rents had tracked the price of cameras—one of the few items to fall in price—monthly costs would be just £973, a level last seen in April 2017.

This comparison highlights how rents have remained somewhere in the middle of the inflation spectrum. They’ve grown faster than essentials like fruit and second-hand cars, but slower than volatile categories like travel and insurance.

Regional Rents – London Leads the Decline

The national picture masks significant regional variation. In August, rents fell in four of the eleven regions across Great Britain, with London leading the decline. Greater London saw rents drop by 3.3% year-on-year, while Inner London experienced a sharper fall of 5.8%. In fact, rents in Inner London are now £179 per month below their October 2024 peak and 1.3% lower than they were two years ago.

This marks the eighth consecutive month of annual rental declines in London, suggesting a sustained shift in landlords’ pricing power. The North East and Yorkshire & Humber also saw annual declines, albeit more modest at 0.2% and 0.5% respectively. These are the first drops in these regions since early 2020.

Elsewhere, rental growth remains in positive territory, though the pace is slowing. The Midlands, South West, and Scotland all posted increases, with the West Midlands leading the way at 2.5% for new lets and 6.8% for renewals. These figures suggest that while some regions are cooling, others continue to see upward pressure—particularly where supply remains tight.

New Lets vs Renewals – The Affordability Gap

In August, the average cost of renewing a tenancy rose by 4.3% year-on-year, compared to the small fall in new let prices. This leaves renewals £90 per month cheaper than moving into a new property.

While this gap is narrower than the £170 peak recorded in October 2023, it remains significantly above pre-Covid levels, when the difference typically ranged between £10 and £20 per month. The average price of a renewed contract still has another 5% to rise if it is to match the growth in the cost of new lets since August 2020. However, the current divergence in annual growth rates—renewals up 4.3% versus a slight dip in new lets—is unlikely to continue. Rental growth on renewals is expected to slow as affordability pressures build.

Like wages, rents don’t often fall. In fact, there have only been six months over the last 14 years when rents have fallen nationally on an annual basis. And when they do, it’s usually in real terms, rather than absolute terms. What we’re seeing now is a real terms fall in rents—when inflation and wages outpace rental growth—which leaves tenants feeling better off. It’s a sign that the rental market is responding to wider economic pressures, and it could help ease the inflation headache for policymakers in the months ahead.